What Does Best Car Insurance Companies In India Mean?

Wiki Article

Best Car Insurance Companies In India for Beginners

Table of ContentsExcitement About Best Car Insurance Companies In IndiaUnknown Facts About Best Car Insurance Companies In IndiaThe 3-Minute Rule for Best Car Insurance Companies In IndiaBest Car Insurance Companies In India Things To Know Before You Buy

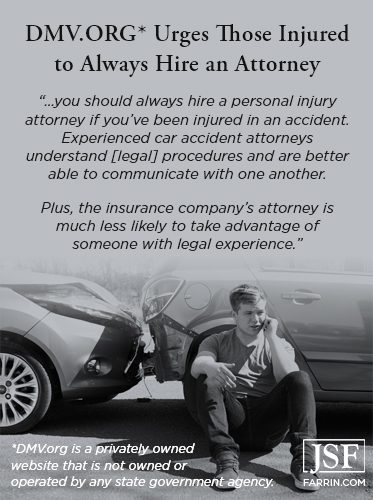

The insurance provider would certainly most likely provide you an amount that is lower than what you have demanded; so you should request for settlement that is concerning 25%-75% greater than what you would certainly go for. It is vital that you have documents that would support every little thing in your demand letter. Else, you may not obtain the whole amount that you should have.This might also be a method from the insurance company to examine whether you know the real worth of the insurance claim. In this scenario, you need to ask the insurance adjustor to validate why the insurance claim quantity is so reduced. React to each of the points in the reply letter with evidence of your expenditures and also why you can decline the proposition.

- When you are working out on your cars and truck insurance policy claim, you ought to highlight on your best factors. If you are enduring from an injury that interrupts the high quality of your life, go over how this will certainly affect you and your family members monetarily and psychologically. If you have missed out on work as a result of the injuries, concentrate on the loss of earnings.

You ought to also ask for the insurance coverage business to videotape all settlement supplies in creating. If you finally agree on an insurance claim value, make sure that it is taped in a contract signed by all stakeholders.

3 Easy Facts About Best Car Insurance Companies In India Explained

Expecting that the insurance coverage company would honour your cases in a simple way is naive. Listed listed below are some car insurance issues that may postpone a claim settlement: - The longer a policyholder waits to submit a claim, the more challenging it comes to be to obtain a fair settlement.- Car insurance companies will certainly not be able to get to a verdict if you do not supply all details of the accident. They would would like to know just how the mishap happened, that was included, and also what the problems are. If you are able to tape this details properly as well as generate proof of the same, your case negotiation process will be a great deal more smooth.

- If 2 automobiles are involved in a mishap, it is all-natural for every chauffeur to move the blame on the various other. Even if a motorist accepts duty for a crash, he/she might alter the stand after talking with his/her insurer. You will certainly constantly need to be prepared for such allegations when you are entailed in a crash.

However you need to make certain that the price of fixing at your neighborhood garage is not over the top. Selecting network garages for mishap repairs serves as you can obtain the auto fixed without needing to compensate front. The financial resources will certainly be straight cleared up between the insurer as well as the network garage.

Indicators on Best Car Insurance Companies In India You Should Know

Just how does your Automobile Insurance Coverage Claim Influence the Costs? Many individuals are of the opinion that submitting a vehicle insurance case will certainly have an adverse effect on their premiums in the future.

No Depreciation Vehicle Insurance Policy Vs Comprehensive Insurance coverage Absolutely no depreciation cover, also understood as bumper to bumper insurance, can be added as an optional coverage to your base vehicle insurance coverage plan. The distinction in between a thorough auto insurance plan and a plan with zero depreciation cover is as revealed below: Costs Varies based on the insurance coverage selected, the insurance holder's history, and also the insurance provider. Best Car Insurance Companies In India.

Lower IDV implies that you will certainly pay lesser costs on your cars and truck insurance coverage; nonetheless, you will certainly obtain lesser insurance cover. The insurance coverage costs that you pay is straight symmetrical to the IDV of the car.

Best Car Insurance Companies In India Can Be Fun For Everyone

Cars and truck insurance policy is offered appropriately. Just How Much is No-Claim Perk for Vehicle Insurance Policy in India? There are certain elements of NCB that you ought to know in order to utilise it successfully: NCB is available to the insurance policy holder only when he/she renews the vehicle insurance coverage. As indicated above, NCB belongs to the insurance holder, not the automobile.The vehicle possession and also insurance policy in this situation will be moved to the heir. It is tempting to raise cases for every little dent that surface areas on your vehicle's body.

Report this wiki page